In just four years, the number of credit cards in Vietnam has doubled. Experts forecast the market’s strong momentum is far from over.

Credit Cards Are Growing at Breakneck Speed | VCR99 Finance & Credit

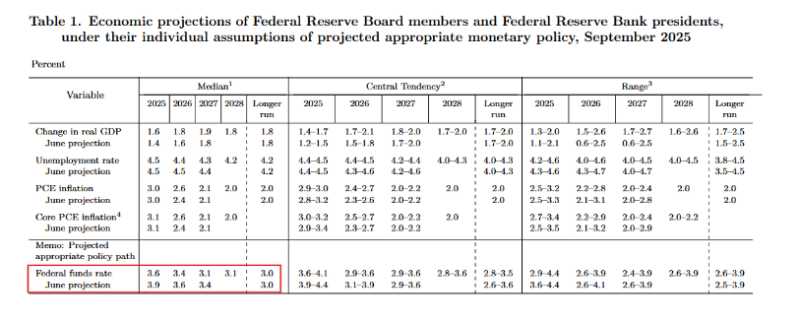

According to a recent analyst report, Vietnam’s credit card market is surging from a relatively low base. Cards in circulation reached 13.1 million in 2024, nearly double the 2020 level, translating to a compound annual growth rate (CAGR) of 15.3%, far outpacing the regional average.

After slowing to 8.7% growth in 2023 amid post-Covid softness in consumer demand, issuance rebounded sharply, accelerating to 18.4% in 2024.

The main growth engines are digitally savvy younger cohorts, the shift to cashless payments, and booming online consumption—spanning e-commerce, food delivery, and livestream shopping.

Credit Cards Are Growing at Breakneck Speed | VCR99 Finance & Credit

Despite the rapid gains, analysts note that market penetration remains modest. Only about 18% of adults (fewer than 2 in 10 people aged 15+) currently hold a credit card—close to the ASEAN average of just over 20% but well below APAC, where penetration exceeds 100% because many people carry multiple cards. This gap implies considerable headroom for Vietnam.

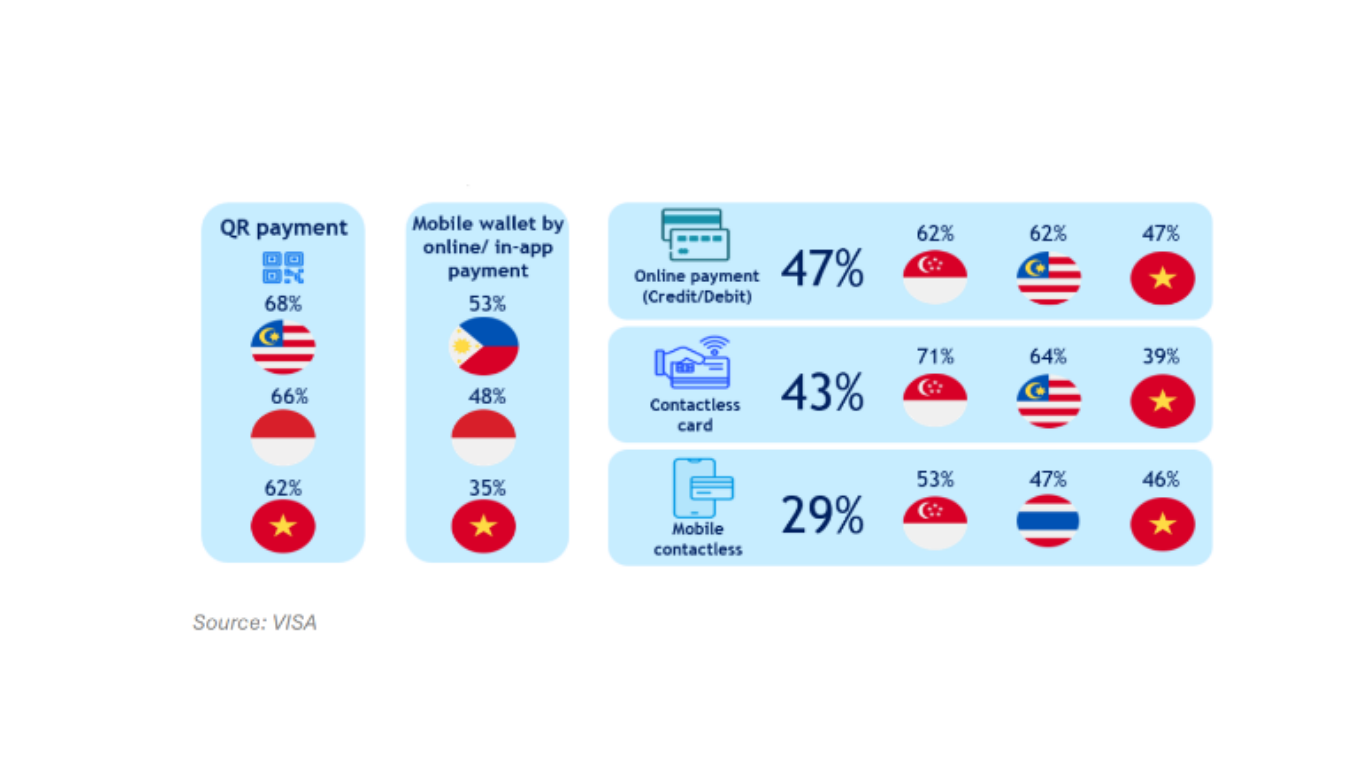

From a low base with high velocity, Vietnam is emerging as a high-potential credit card market, especially as banks and global payment networks expand acceptance, integrate QR codes, contactless, and virtual cards to match evolving consumer behavior.

The Edge of Domestic Credit Cards | VCR99 Finance & Credit

According to Tran Thi Kieu Oanh, Head of Financial Services Research & Advisory at FiinGroup, Vietnam’s card landscape is a vibrant arena where international networks and domestic rails coexist. Global brands still dominate with their broad acceptance, cross-border connectivity, and e-commerce integration, while domestic credit cards offer lower costs and mass-market reach.

Although domestic credit cards currently account for a smaller share, they are playing an increasingly important role in Vietnam’s payment ecosystem. The number of domestic credit cards has climbed from 467,000 in 2020 to nearly 902,000 in 2024, with periods of 25%+ annual growth before easing in 2023–2024.

The biggest difference lies in customer-acquisition strategy. International cards target urban, higher-income segments with premium services and online shopping perks. By contrast, domestic credit cards—backed by NAPAS and a 24/7 payments infrastructure—aim to reach the mass market, including consumers who have never used, or struggle to access, traditional credit products.

As users become more fee-sensitive and digital payment habits spread into rural areas, domestic credit cards have natural advantages: lower cost, easier issuance, and seamless integration with QR and contactless payments. These strengths could help domestic issuers break into mass segments where international brands are not yet fully penetrated.

With a young population, rising incomes, and double-digit e-commerce growth, Vietnam remains a high-potential market. Domestic cards are unlikely to replace international ones; rather, they complement and expand the market, gradually carving out their own position within the payment ecosystem.

Banks Must Double Down on Technology in the Credit-Card Race | VCR99 Finance & Credit

Today’s user behavior is shaped by three factors: digital convenience, consumer rewards, and trust in security. Consumers increasingly favor fast, mobile-first payment methods—QR codes, e-wallets, mobile banking, contactless cards. The rise of super-apps and e-commerce is reinforcing these habits. At the same time, cashback, reward points, shopping vouchers, and dining/entertainment offers have made credit cards a mainstream spending tool, especially among young people and the middle class, pushing the share of card-based payments higher in recent years.

Security is also paramount. With growing attention to biometric authentication, eKYC, and OTPs, banks are being compelled to invest heavily in fraud prevention technology to safeguard trust in digital transactions.

According to Ms. Oanh, over the next 3–5 years credit cards are expected to maintain double-digit growth, powered by Millennials and Gen Z, who have a strong appetite for digital consumption. Virtual cards, QR integration, and contactless are likely to become dominant formats, tied closely to digital-banking ecosystems and super-apps.

Overall—based on VCR99’s in-depth assessment—the Vietnamese card market is shifting from a focus on “growing the base” to “competing on quality and user experience,” reflecting modern consumption trends and the rapid digitalization of the economy.