Gold prices are projected to climb in the short term, supported by multiple factors. Let’s explore VCR99’s analysis of the opportunities, risks, and upcoming investment trends.

1. Current Overview of the Gold Market – VCR99

According to Investing, gold continues its upward trend and many experts predict that prices will keep rising in the short term. VCR99 identifies the main drivers as:

-

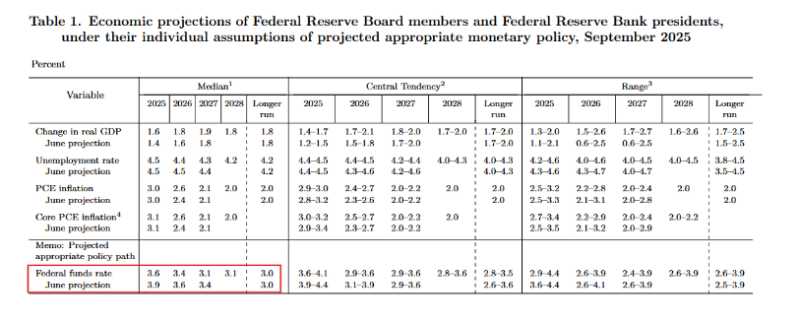

Interest rate expectations: Flexible monetary policies make gold an attractive safe-haven asset.

-

Geopolitical and global economic volatility: Uncertainty is boosting demand for safe assets.

-

Investment flows: Foreign capital and gold ETFs continue to record steady inflows.

2. Why Is Gold Still Expected to Rise?

There are three key reasons:

-

Inflation and the USD: When the US dollar is under pressure, gold typically benefits.

-

Central bank policies: The potential for rate cuts or persistently low interest rates enhances gold’s appeal.

-

Safe-haven demand: Amid instability, gold retains its role as a defensive asset.

3. VCR99’s View: Opportunities and Risks

👉 Opportunities:

-

Rising gold prices may generate additional short-term profits for investors.

-

Both institutions and individuals can use gold as a tool for wealth preservation.

👉 Risks:

-

Sharp short-term fluctuations if monetary policy shifts unexpectedly.

-

Wide bid–ask spreads may affect actual profitability.

VCR99’s assessment: Investors should carefully consider the proportion of gold in their portfolios and combine it with other asset classes to optimize returns while reducing risks.

4. Gold Investment Outlook – VCR99’s Assessment

-

Short term: Gold prices are likely to continue rising, especially if the FED maintains supportive policies.

-

Medium term: Investors should monitor inflation, GDP figures, and geopolitical developments.

-

Long term: Gold remains a safe asset, suitable for wealth preservation strategies.

5. VCR99’s Conclusion

Gold is forecasted to keep rising in the short term, but investors should not ignore volatility risks. VCR99 recommends maintaining an investment strategy based on transparency, diversification, and discipline to achieve long-term effectiveness.

This article is for informational purposes only and does not constitute investment advice.