Introduction

In 2025, financial and real estate markets are expected to continue facing major fluctuations. Finding ways to access a low interest loan to take advantage of real estate investment 2025 has become a strategy many investors are focusing on. This case study by VCR99 provides a detailed analysis of loan types, how to optimize borrowing costs, and the potential of the real estate market in the upcoming period.

1. Low Interest Loan – Understanding It Clearly

What is a loan interest rate?

A loan interest rate is the cost a borrower must pay to a bank or financial institution based on the borrowed amount and loan term. Accessing a low interest loan helps reduce financial pressure and increase potential returns from investments.

Factors affecting interest rates

-

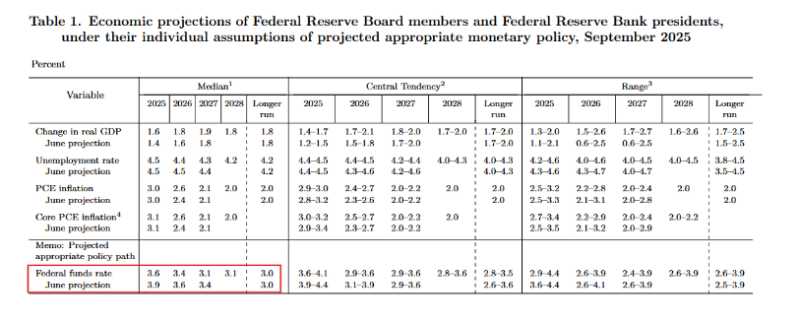

Monetary policies and inflation.

-

The borrower’s credit profile.

-

Loan duration (short-term loans usually have higher rates than long-term loans).

-

Collateral or guarantees provided.

How to access a low interest loan

-

Maintain a transparent and positive credit history.

-

Choose reputable banks or financial institutions.

-

Compare multiple loan packages before making a decision.

-

Prioritize long-term loans for real estate investment purposes.

2. Real Estate Investment 2025 – Trends and Opportunities

Market trends

According to experts, real estate investment 2025 will be influenced by:

-

Expansion of urban infrastructure and industrial zones.

-

Increasing demand for housing and serviced apartments in major cities.

-

Strong recovery of resort and tourism-related properties.

Investment opportunities

-

Suburban land: still affordable with strong growth potential.

-

Mid-range apartments: stable demand from real housing needs.

-

Commercial properties: benefiting from FDI inflows and domestic consumption growth.

With these trends, combining a low interest loan with property purchases may bring attractive medium- and long-term profits.

3. Case Study: Investor A in 2025

-

Context: Investor A plans to purchase a mid-range apartment worth 2 billion VND.

-

Financial solution: Borrowing 50% of the property value from a bank with a low interest loan at 8% fixed for 3 years.

-

Strategy: Renting out the apartment to generate monthly income for interest payments.

-

Expected outcome: After 5 years, the property value increases by around 30%, while loan costs remain manageable thanks to the chosen low interest package.

4. Strategies for Investors in 2025

When should you take a low interest loan?

-

When you already have a clear financial plan.

-

When the real estate market shows signs of growth.

-

When you have stable income sources to cover loan repayments.

How to maximize returns?

-

Choose properties in strategic locations.

-

Take advantage of bank loan incentives.

-

Manage rental income and repayment plans effectively.

Conclusion

This case study from VCR99 shows that choosing a low interest loan not only reduces borrowing costs but also opens up opportunities to maximize profits in real estate investment 2025. The smart combination of well-structured loan strategies and selecting high-potential properties will be the key to success for investors in the coming years.